On the flip side, financial commitment groups may also be costly and need a specified degree of expertise and normal checking and upkeep. In the long run, it’s as many as the individual to choose if an expense group is right for them.

Enhanced Diversification: By having an expenditure group, you could unfold your investable cash across several investment decision chances instead of Placing all of your eggs in one basket.

If you don’t provide the expertise, experience, or time and energy to navigate all the right SEC specifications while in the pursuit within your expenditure, an SPV might not be the correct fit in your financial investment group.

Even though there are plenty of pros to joining an expense club, There's also some opportunity drawbacks. The group’s financial investment conclusions might not normally be in the best curiosity of all users. This can be very true In case the club does not have knowledgeable expenditure advisor.

Moreover, syndication provides a amount of control that isn’t always readily available in group investing. Collaborating investors in syndication can pick towards which precise Attributes they wish to contribute cash.

Professional tip: A portfolio typically gets to be much more sophisticated when it has additional more info investable belongings. You should answer this question that can help us join you with the correct Skilled.

These companions are answerable for the SPV’s debts—this means they’re around the hook. Then again, limited companions are silent or passive investors in the deals pursued through the SPV.

Valur can make it straightforward and seamless for our buyers to utilize the tax-advantaged structures that are normally high-priced and inaccessible to develop their wealth a lot more successfully.

A MOV is made up of a founder, or maybe the leader from the group, and customers, that are equal participants and contributors towards the group’s investing efforts.

A financial Experienced will provide guidance dependant on the knowledge supplied and offer a no-obligation call to higher fully grasp your predicament.

Crowdfunding is an excellent fit for startup founders wanting to fund their developing company with mates, family members, employees. If this sounds like you, crowdfunding may very well be an choice for your investing journey! An additional beauty of crowdfunding is accredited and non-accredited investors.

Reduce danger: Buying a group spreads your risk amid all group users, creating your particular person investment decision fewer dangerous.

Conflicting investment decision goals and anticipations amongst group members may result in disagreements, inefficiencies, and suboptimal financial commitment outcomes.

On the web real-estate financial commitment clubs give you a virtual platform for investors to connect, share facts, and collaborate on expense possibilities. These golf equipment could host webinars, and on the web boards, and supply resources for customers to obtain remotely.

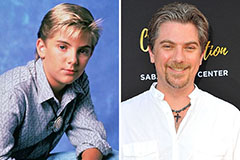

Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!